Have you ever wondered how some people seem to effortlessly build wealth while keeping their tax bills low? The secret often lies in smart financial planning and strategic structuring. Today, we're going to explore the V-shaped method—a powerful framework that can help you take control of your financial future.

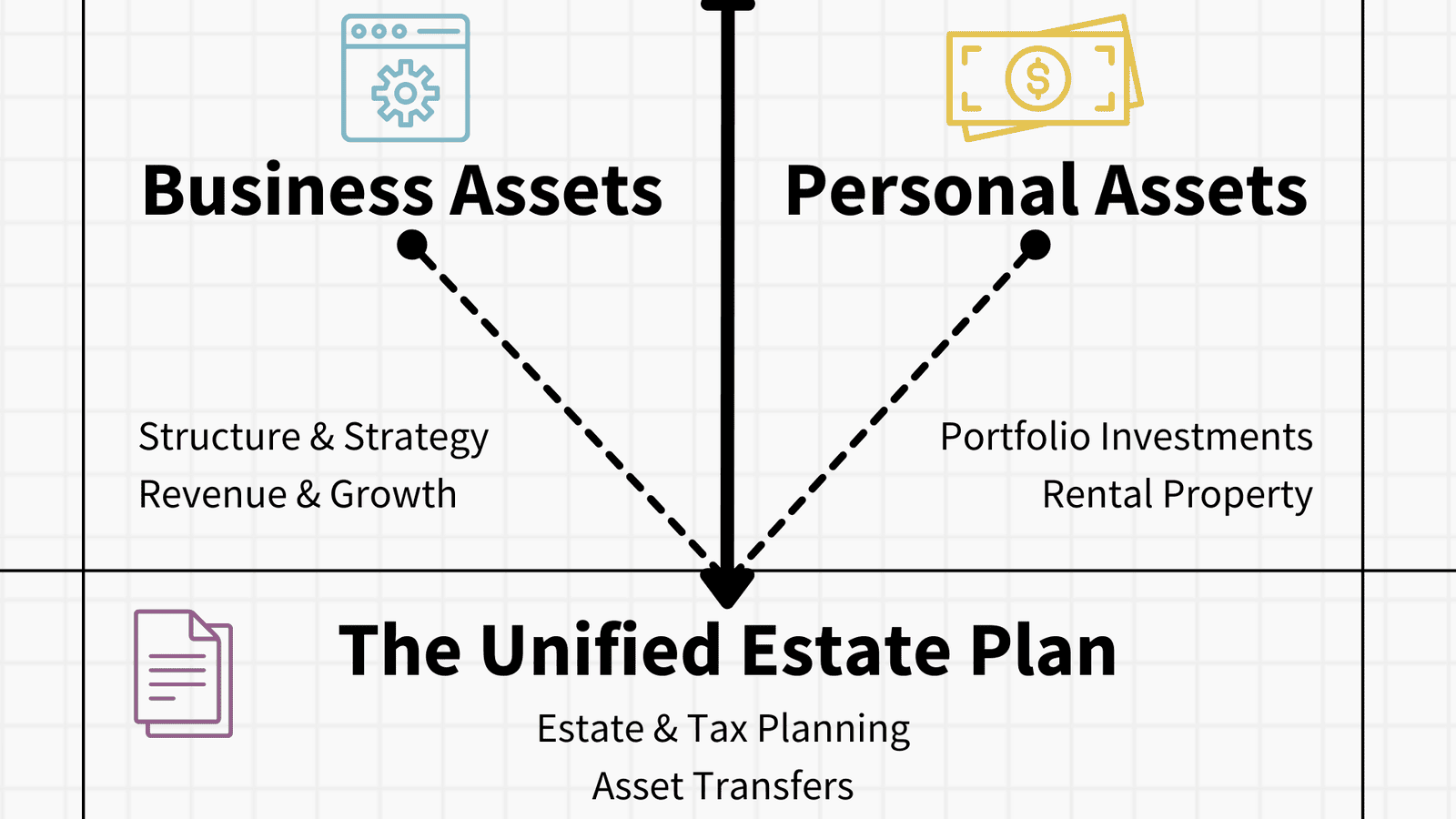

The V-shaped method brings together three essential components arranged in an inverted pyramid structure. At the top, you have two distinct asset categories: your business assets (including structure, strategy, revenue, and growth) and your personal assets (including portfolio investments and rental property). These two streams flow down and converge into a unified estate plan at the base, which encompasses both structure and strategy for long-term wealth preservation. By integrating these elements, you can protect your assets, optimize your taxes, and set the stage for generational wealth transfer.

Understanding the V-Shaped Structure

The V-shaped method gets its name from the visual structure of how these components work together. Picture an inverted pyramid or a "V" shape: at the top left, you have your business assets—your operational LLC handling structure, strategy, revenue generation, and growth. At the top right, you have your personal assets—your investment LLC managing portfolio investments and rental properties. Both of these asset streams flow downward and converge at a single point: your unified estate plan. This bottom component ties everything together with comprehensive structure and strategy for wealth preservation and transfer.

This visual framework helps you understand how each component relates to the others. Your business generates income and builds value, your investments grow wealth and provide diversification, and your estate plan ensures that both streams are protected and efficiently transferred according to your wishes. The V-shape reminds us that while you maintain separation between business and personal assets for liability protection, they ultimately unite in a cohesive estate planning strategy.

Setting Up Your Operational Business (LLC)

Starting with your business, structuring it as a Limited Liability Company (LLC) offers several benefits. An LLC separates your personal assets from your business liabilities, which means that if your business faces lawsuits or debts, your personal savings and property are generally shielded. Just remember to keep business and personal finances separate to maintain this protection.

With an LLC, you have choices in how you're taxed. You can stick with the default pass-through taxation, where profits and losses show up on your personal tax return, or you can choose to be taxed as an S-corporation or C-corporation, depending on what's best for your situation. Compared to corporations, LLCs come with fewer formalities and compliance requirements, making them easier to run while still providing legal protections.

Consider this example: imagine you're a freelance graphic designer operating as an LLC. If a client sues you over a project dispute, only your business assets are at risk—not your personal bank account or home.

Creating an Investment Entity (LLC)

Next, consider setting up a separate LLC to hold your investments. By keeping your investments in their own LLC, you shield them from any issues that might arise in your operational business. This is especially important if your business activities carry higher risks. Managing investment income and expenses separately can help reduce your overall tax bill, as you can offset investment losses against gains within the investment LLC and explore strategies that offer tax benefits. Separating your business and investment activities also makes it easier to keep track of finances and simplifies your record-keeping.

Suppose you own a small marketing agency and you also invest in rental properties. By placing the properties in an investment LLC, you protect them from any liabilities related to your marketing business. This separation creates a firewall between your operating business and your investment portfolio.

Establishing Your Estate Planning Foundation

For Washington State residents, estate planning looks different than in many other states. Washington has both streamlined probate procedures and its own estate tax, and understanding this unique landscape is crucial for proper planning. Many people mistakenly believe that a revocable living trust will help them avoid Washington's estate tax—it won't. However, proper estate planning is still crucial for other reasons.

If you set up your will correctly, Washington offers one of the most efficient probate processes in the country. This means that for many people, the traditional "avoid probate" argument for trusts is less compelling here than in other states. A revocable living trust may still be valuable if you own property in multiple states, want enhanced privacy (probate is public while trusts are private), have a blended family with complex distribution wishes, want to plan for incapacity with seamless management transition, or have business interests that need continuous management.

Washington's estate tax kicks in at a much lower threshold than the federal estate tax, currently $2.193 million for 2024. If your estate exceeds this amount, you'll need specific strategies like gifting during your lifetime, irrevocable life insurance trusts, charitable remainder trusts, family limited partnerships, or other advanced estate tax reduction techniques. It's important to understand that a revocable living trust does not reduce or avoid Washington State estate taxes—only specific irrevocable planning techniques can achieve estate tax reduction.

Consider a Seattle entrepreneur with a $3 million estate who works with an attorney to create a properly structured will that takes advantage of Washington's streamlined probate process, combined with strategic lifetime gifting to reduce their taxable estate below the Washington threshold. This approach recognizes the realities of Washington law rather than relying on strategies designed for other states.

Cutting Taxes with the S-Corporation Election

If your business is doing well, you might benefit from electing S-corporation (S-Corp) status for your operational LLC. An S-Corp is a tax status that allows profits and losses to pass through to your personal tax return, avoiding double taxation. As an S-Corp owner, you can pay yourself a reasonable salary and take the rest of the profits as distributions. Only the salary is subject to self-employment taxes, potentially saving you money. Additionally, distributions aren't considered earned income, which can open up opportunities for larger retirement contributions.

The IRS expects you to pay yourself a reasonable salary based on industry standards and your role in the company. Skimping on your salary to avoid taxes can lead to penalties, so it's important to work with a tax professional to determine what constitutes reasonable compensation in your industry.

For example, a consultant elects S-Corp status, pays herself a salary of $70,000, and takes an additional $30,000 as distributions. Only the $70,000 is subject to self-employment taxes, resulting in significant savings compared to treating the entire $100,000 as self-employment income. Choosing S-Corp status depends on factors like your business income and willingness to handle extra paperwork, so it's wise to consult a tax professional to see if it makes sense for you.

Building Wealth Through Smart Investments

Now that your business and investments are properly structured, it's time to focus on growing your wealth. Spreading your investments across different asset classes helps manage risk and enhance returns. Real estate investments can provide rental income and potential appreciation, with benefits including tax deductions like depreciation and strategies like 1031 exchanges to defer capital gains taxes. Self-directed IRAs allow you to invest in alternative assets like real estate or private companies within your retirement accounts, offering more flexibility than traditional IRAs. Traditional investments like stocks and bonds still play a crucial role in diversification—consider index funds for broad market exposure or dividend-paying stocks for income.

The key is to define your financial goals, assess your risk tolerance, and develop an investment strategy that aligns with both. A small business owner might use profits to invest in a mix of rental properties, stocks, and a self-directed IRA holding real estate, creating multiple income streams that work together to build long-term wealth.

Self-Directed IRA Investment Options

Self-directed IRAs open up a world of investment possibilities beyond traditional stocks and bonds. Real estate options include residential and commercial properties, Real Estate Investment Trusts (REITs), mortgage notes, and undeveloped land. Private equity investments can include private companies, limited partnerships, joint ventures, and startups. You can also invest in precious metals like gold, silver, platinum, and palladium, or commodities such as energy resources, oil and gas, agricultural products, and timber. Tax liens and deeds, including tax lien certificates, property tax liens, and tax deeds, are another option. Cryptocurrency investments like Bitcoin, Ethereum, and other digital assets are also permitted.

However, there are important restrictions to understand. Prohibited investments include life insurance contracts, collectibles such as art and antiques, and certain coins. Prohibited transactions include self-dealing, transactions with family members, and personal use of assets. Requirements for self-directed IRAs include using a qualified custodian, maintaining IRS compliance, and conducting proper due diligence on all investments.

It's essential to consult with a financial advisor or tax professional to determine suitable investments for your SDIRA and ensure compliance with IRS regulations. The flexibility of self-directed IRAs comes with responsibility, and proper guidance can help you avoid costly mistakes.

Maintaining Compliance and Adapting to Change

Proper legal structure requires ongoing attention and periodic review. Entity structures and estate plans should be reviewed at least annually, or when significant life changes occur such as marriage, divorce, birth of children, acquisition of substantial assets, changes in business operations, or relocation to another state. Stay informed about changes to tax laws and regulations—especially Washington State-specific developments like adjustments to estate tax thresholds and modifications to probate procedures. Work with qualified CPAs, attorneys, and financial advisors who understand Washington State law and can help you navigate the unique aspects of doing business and estate planning in this jurisdiction.

The V-shaped method provides a solid framework for asset protection and tax optimization, but its effectiveness depends on proper implementation and ongoing maintenance. By maintaining your operational business structure, keeping your investments properly segregated, and ensuring your estate plan reflects Washington's unique legal landscape, you create a comprehensive approach to legal and financial planning that can serve you and your family for generations. Regular review ensures that your structure continues to meet your needs and remains compliant with current law.

This information is for educational purposes only and should not be considered legal or tax advice. Always consult with a Washington State attorney first before making financial or estate planning decisions.